On Thursday 2nd May, UnderwriteMe attended the Women in Protection conference at the London Marriot Hotel. We took this opportunity to leverage the data from our Protection Platform to understand further, how customers buy insurance.

Our speakers, Katie Dennehy and Steve Baldry spoke about the differences in disclosures between men and women and discussed how we can help create solutions for clients with insightful input from our four fantastic panellists Kerrie Cross, Neal Cross, Paula Bertram-Lax and Nicola McKenzie.

The panel discussion also covered how customers answer their underwriting questions and what policies they buy. We found some interesting insights.

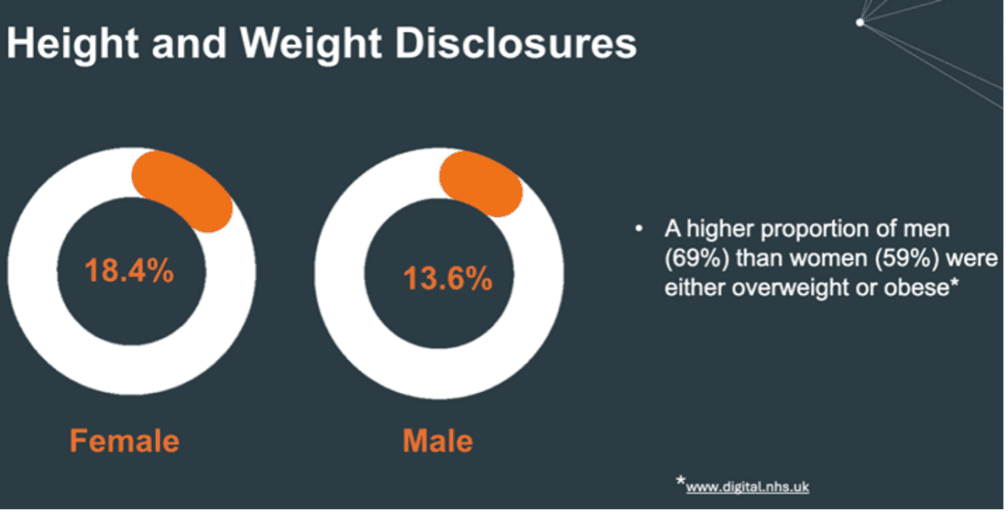

Women are more forthcoming about pre-existing health conditions compared to men. However, they are also more likely to receive adjusted premiums (ratings) despite population studies suggesting otherwise.

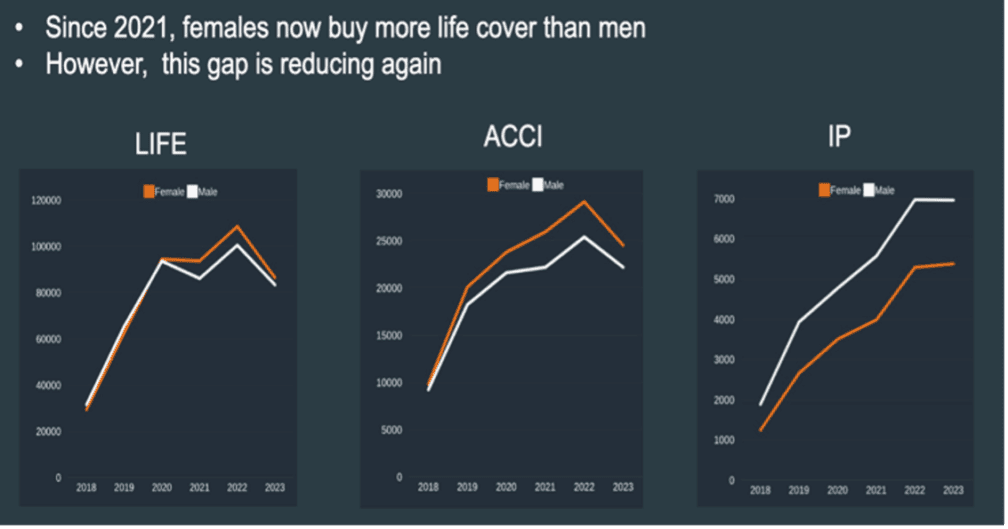

Here's another key takeaway: while men continue to dominate Income Protection purchases, there's a surge in women opting for Life and Critical Illness cover, particularly since 2021. This trend suggests a narrowing gender gap in protection priorities.

Turning Insights into Action

So, what can you, as a financial adviser, learn from this data?

Here's how it can empower your sales, marketing, and underwriting strategies:

Tailored Communication: Women may require a more nuanced approach to discussing health. Consider using clear, non-judgmental language to encourage open disclosure.

Product Focus: The rise in female demand for Life and Critical Illness cover presents an opportunity. Ensure you have a strong understanding of these products and their unique value propositions for women.

Bridging the Gap: While Income Protection remains male-dominated, the trend is shifting. Be prepared to address potential concerns women may have about Income Protection and its role in their financial security.

Data-Driven Approach to Better Protection Sales

By leveraging real-world data on customer preferences and needs, you can create a smoother insurance buying experience for everyone. UnderwriteMe empowers distributors and insurers to provide clients with the protection they truly need.

Ready to take your sales efforts to the next level?

We managed to have lots of conversations on our stand, but whether you were able to speak to us or not, contact UnderwriteMe to learn more about how our Protection Platform can equip you to source fully underwritten decision for your clients in real time to address their protection needs: hello@underwriteme.co.uk